Introduction

An industry's maturation is judged at the moment discussion changes from pragmatic day-to-day details and industry trends to the questions about valuation of a practice. When dental lab owners begin to ask: What is my dental lab worth if sold to another lab owner in contrast to its sale on the open private and public equity capital markets?

This article is intended to assist the dental lab owner in answering this question.

The dental lab versus capital market

The dental lab market in the U.S. consists of about 7,000 existing labs that service the retail dental industry. These labs employ approximately 42,000 people with a revenue of $4 billion in annual sales.1

Thomas Climo, PhD, is a dental practice management consultant and a past professor of economics in England.

Thomas Climo, PhD, is a dental practice management consultant and a past professor of economics in England.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) margins in the industry are in the 11% to 13% range, meaning the $4 billion of revenue translates into approximately $440 million to $520 million of EBITDA. Without access to a capital market, this is the total amount of free cash flow available in the dental lab market for the acquisition of dental labs.

By contrast, the capital market, defined as the financial markets for the buying and selling of long-term debt or equity-backed securities, annually allocates in the U.S. alone around $2,000 billion of debt and $200 billion of equity.

Having access to $200 billion compared with $440 million to $520 million as a market resource for selling a lab represents a sizable difference. Capital markets swamp private dealings in the dental market by sheer volume and availability of funds. In the pie chart below, the blue sliver of available dental lab funds is surrounded by the orange block representing available funding in the equity capital market.

Availability of funds

It is for this reason that, when valuation questions arise, informed owners turn not to what price a fellow lab owner might pay for a lab, but what price an open market would pay where capital constraint is not a major consideration, and where a known metric for the quantification of value is impounded and established.

In the next section, this capital market metric is examined in its two different interpretations, either of which provides lab owners with a sophisticated method for determining the market price or market worth of their dental lab.

Before doing so, we examine the dental lab market from the vantage point of a sale to another lab owner or investor(s) associated with lab owners.

Valuation of a dental lab in a private noncapital market

While the objective of buying a lab in a capital market is straightforward and has a singular objective, selling a lab to another lab owner is fraught with a variety of objectives that introduce semantic noise into the negotiations.

The chart below borrows from strengths, weaknesses, opportunities, and threats (SWOT) analysis in proving this point.

| A dental lab owner buying a dental lab or a dental lab owner selling a dental lab |

||

| Strengths |

Weaknesses |

|

| Opportunities |

Threats |

|

In other words, goals other than economic ones have entered into the lab owners negotiations, and the price swings from low to high depending on point of view. The crossover point may be to the favor of the buyer or the seller. Without knowledge of economic value, there is no way in which to tell whether the buyer or the seller is the winner.

Economic valuation is much more objective and selectively subjective than negotiations between fellow lab owners. Economic valuation draws on the one singular objective of a capital market -- to find repeatable net income or EBITDA and price the lab on the basis of this amount and this amount only.

Of course, accurate accounting is expected from the employment of such an economic model, so, even here, there is a degree of uncertainty contained in an economic evaluation of a dental lab. Bad accounting yields bad value. Still, as a placeholder of a price to expect from the purchase or sale of a laboratory, economic value is vastly superior to a model in which owner savvy and leverage have more to do with the purchase price than objective and demonstrable performance of a laboratory.

Valuation of a dental lab in a capital market

Dental labs are valued no differently than any other business entity. There are two schools.

One school -- called the private equity school for a reason to be explained in a moment -- prefers EBITDA as its numerator in a valuation formula as old as John Maynard Keynes' General Theory of Employment , Interest, and Money:2

V = EBITDA (j) ÷ r

Where:

V = Value of the dental lab

EBITDA = Operating income before interest, taxes, depreciation, and amortization

j = Date of the valuation

r = Cost of capital of an industry in the empirical dataset from the New York University Stern School of Business. This dataset consists of more than 2,000 companies in over 100 industries. "Public/private equity cost of capital" is listed at 10.97% as of January 2013.

Therefore, if operating income at the dental lab is $1 million at year-end 2012, then, under this school of thought, the dental lab has the following valuation at year-end 2012:

$1,000,000 ÷ 10.97% = $9,115,770

The second school -- called the Warren Buffet school for a reason to be explained in a moment -- prefers for the numerator to be net income and includes a provision for depreciation. Therefore, if the depreciation or capital maintenance allocation is one-fifth of operating income, net income at the dental lab is $800,000 at year-end 2012. Under this school of thought, the dental lab has the following valuation at year-end 2012:

$800,000 ÷ 10.97% = $7,292,616

The first, or private equity school of valuation, is favored by private equity groups because their objective is to learn the value of the company from an operating point of view. Since they will buy the lab and likely eliminate the debt, or find more suitable debt to their liking, private equity has little interest in the ability of a dental lab owner to arrange and choose financing options. So, out goes interest and amortization. Taxes are a part of life, but, once again, private equity has more learned tax attorneys and tax accountants than dental lab owners, so private equity has little interest in valuing the ability of the dental lab owner to reduce tax liability. Lastly, private equity does not see depreciation as a cash flow expense, rather as an accounting construction that can be added back.

The second, or Warren Buffet school, can best be expressed by Mr. Buffet himself. I run with two classic quotes of his taken from the 2002 annual report for Berkshire Hathaway:

We'll (Berkshire Hathaway) never buy a company when the managers talk about EBITDA. There are more frauds talking about EBITDA. That term has never appeared in the annual reports of companies like Wal-Mart, General Electric, or Microsoft. The fraudsters are trying to con you or they're trying to con themselves. Interest and taxes are real expenses. Depreciation is the worst kind of expense: You buy an asset first and then pay a deduction, and you don't get the tax benefit until you start making money. We have found that many of the crooks look like crooks. They are usually people that tell you things that are too good to be true. They have a smell about them.

Trumpeting EBITDA (earnings before interest, taxes, depreciation and amortization) is a particularly pernicious practice. Doing so implies that depreciation is not truly an expense, given that it is a "non-cash" charge. That's nonsense. In truth, depreciation is a particularly unattractive expense because the cash outlay it represents is paid up front, before the asset acquired has delivered any benefits to the business. Imagine, if you will, that at the beginning of this year a company paid all of its employees for the next ten years of their service (in the way they would lay out cash for a fixed asset to be useful for ten years). In the following nine years, compensation would be a "non-cash" expense – a reduction of a prepaid compensation asset established this year. Would anyone care to argue that the recording of the expense in years two through ten would be simply a bookkeeping formality?

I side with Warren Buffet and have expressed my opinion on this in a number of articles.3,4

It should be noted that private equity often ratchets down to approximate the Buffet valuation by either adding a risk premium to the cost of capital rate or reducing the company's EBITDA with an adjustment eliminating one-time or nonrecurring operating income items.

The justification for a Buffet valuation works this way. If you take as your definition of income the classic and best description provided by J.R. Hicks in Value and Capital5 as "the maximum amount a person can consume during a week and still expect to be as well-off at the end of the week as he was at the beginning," there is no way that depreciation can be excluded from the valuation formula. It is not a simple noncash expense. Crude as accounting deprecation might be, it is the only avenue we have for ensuring that a company's capital has been maintained intact.

Failure to maintain a company's capital intact is a failure to generate income.

Summary

The power of the Theory of Finance6 has now been placed firmly in the analytical arsenal of the dental lab owner. To sell at a price below the valuation expressed in the metric or formula provided herein is to put money into the buyer's pocket and out of yours.

You've been doing it for years, but at least now you will know 1) that you are doing it, and 2) the exact amount you are leaving on the table.

Thomas Climo, PhD, is a professor emeritus of accounting and finance at a major university in the U.K. He has published extensively about the importance of modern managerial and financial decision-making for dentistry. He is a consultant to corporate and solo practitioner dental practice management companies in the states of Arizona, California, Connecticut, Nevada, New Hampshire, New York, and Massachusetts. He can be reached by email at [email protected] or by telephone at 702-578-2757.

The comments and observations expressed herein do not necessarily reflect the opinions of DrBicuspid.com, nor should they be construed as an endorsement or admonishment of any particular idea, vendor, or organization.

References

- Dental Laboratories in the US: Market Research Report. IBIS World. November 2012. http://www.ibisworld.com/industry/dental-laboratories.html.

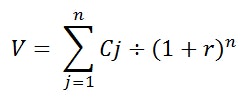

- I use the collapsed or annuity version of the valuation formula which only works when the numerator is a repeatable number, as in an annuity investment. Where "C" stands for either EBITDA or net income, the expanded version is represented by the well-recognized and conventional discounted cash flow formula:

- Climo TA. What is your practice really worth? DrBicuspid.com. July 11, 2012, https://www.drbicuspid.com/dental-practice/office-management/insurance/article/15365261/what-is-your-practice-really-worth.

- Climo TA. A financial lesson for dentists. DrBicuspid.com. October 18, 2012. https://www.drbicuspid.com/dental-business/practice-sales/article/15365900/a-financial-lesson-for-dentists.

- Hicks JR. Value and Capital. Oxford, U.K.: Clarendon Press; 1939:172.

- Two Nobel Laureates in Economics produced the most powerful book available on the subject: Fama EF, Miller MH. The Theory of Finance. New York: Holt, Rinehart, and Winston; 1972.