Previous DrBicuspid.com articles of mine have made the case for the economic evaluation of dental practices.

Thomas Climo, PhD, is a dental practice management consultant and a past professor of economics in England.

Thomas Climo, PhD, is a dental practice management consultant and a past professor of economics in England.

In this scenario, the practicing dentists work up their revenues in such a manner that replicating this revenue year in and year out is a fairly certain and predictable phenomenon. Attention to management has generated a net repeatable income.

When net repeatable income is divided by annual sales, this tells us the net income margin for the year. Average net income margin for the dental services sector is 4.74%, a remarkably low profit margin.

When net income is in a repeatable format, the annuity formula kicks in:

V = NI(j) ÷ r

Where:

V = Value of the dental practices

NI = Net income defined as earnings before interest, taxes, depreciation, and amortization (EBITDA) less interest, taxes, depreciation, and amortization (I have always liked the definition of income provided by J.R. Hicks in Value and Capital, 1939, p. 172: "the maximum amount a person can consume during a week and still expect to be as well-off at the end of the week as he was at the beginning.")

j = Date of the valuation

r = Cost of capital of an industry in the empirical dataset from New York University Stern School of Business (This dataset consists of more than 2,000 companies in over 100 industries. For dental services, I use the "public/private equity cost of capital" as this is an objective indicator of a commercial sector with interest in buying dental practices. The January 2012 cost of capital for this sector is 10.78%.)

When we turn from economic analysis to the manner dental practices are quantified as to sales price in the market, a move is made from net income to a percentage of total revenues.

I won't go into the rationale of this approach, but know that dental practices are evaluated, by Henry Schein, Paragon, and other appraisers of dental practices by the following formula:

A dental practice is valued on the basis of the net collections of the prior year as recorded and confirmed by the practice multiplied by a set percentage rates of between 60% to 90% with choice of which range of percentage to use consisting of a mixture of asset aging, net cash flow, and goodwill, defined as the difference between accounting assets and the purchase price recommended by Schein or Paragon.

This market formula approximates to my use of net income margin in the following manner:

- Negative net income margins categorize practices selling below 60% of prior year revenues.

- Net income margins of 0% to 1% categorize practices selling at 60% of prior year revenues.

- Net income margins of 2% to 3% categorize practices selling at 65% of prior year revenues.

- Net income margins of 4% to 5% categorize practices selling at 70% of prior year revenues.

- Net income margins of 6% to 7% categorize practices selling at 75% of prior year revenues.

- Net income margins of 8% to 9% categorize practices selling at 80% of prior year revenues.

- Net income margins of 10% to 11% categorize practices selling at 85% of prior year revenues.

- Net income margins of 12% and above categorize practices selling at 90%+ of prior year revenues.

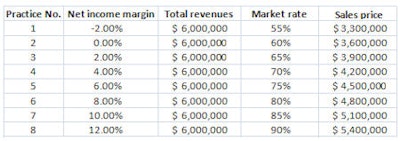

In other words, for eight different practices each with the same total revenue of $6 million, the following market valuations or sales prices are derived from the net income margins disclosed:

|

This produces a prospective range of sales prices from $3.3 million to $5.4 million.

Finally, we have some semblance of connection between economics and the pricing of dental practices in the dental services industry.

So the financial lesson for dentists is this: Move up your net income margin and watch your practice sales price move up with it.

End note: Empirical confirmation of the correlation between net income margin and dental practice sales price is an interesting avenue of scholarly pursuit I highly recommend to a postgraduate student in business finance with an interest in business operations. My findings in this article are based on about 100 dental practice sales and their coordination with mostly noncertified financial statements. Financial statements of dental practices cannot be taken "as is," as often owner salaries as an operating expense masquerade as balance sheet withdrawals instead of the legitimate appearance on the profit and loss statement. Also, depreciation is a much ill-treated matter in most of these financial statements. The net income margin I use is based on the economic net income I derive from recalibrating the dental practices financial statements.

Thomas Climo, PhD, is a professor emeritus of accounting and finance at a major university in the U.K. He has published extensively about the importance of modern managerial and financial decision-making for dentistry. He is a consultant to corporate and solo practitioner dental practice management companies in the states of Arizona, California, Connecticut, Nevada, New Hampshire, New York, and Massachusetts. He can be reached by email at [email protected] or by telephone at 702-578-2757.

The comments and observations expressed herein do not necessarily reflect the opinions of DrBicuspid.com, nor should they be construed as an endorsement or admonishment of any particular idea, vendor, or organization.