Straumann Group reported a 2% decline in revenues for the first half of 2013, due in large part to continued economic weakness in most European countries.

First-half 2013 revenue was 355 million Swiss francs ($387 million), down from 362 million francs ($394 million) in the same period a year ago, the company noted in a press release.

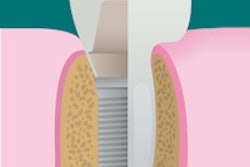

Implant sales progressed positively in the first half of 2013, lifted by solid growth in the second quarter. The restorative business -- comprising digital products, CAD/CAM milled elements and standard prosthetics -- was generally slower, reflecting the competitive landscape, according to Straumann.

First-half revenues in Europe fell 4% year over year, which the company attributed to the ongoing economic recession, especially in Southern Europe. Large markets such as Spain and Italy, which are also constrained by low-price competitors, continued to suffer the biggest declines, Straumann officials noted. In contrast, less-well-penetrated markets such as France, Switzerland, and the U.K. returned to growth in the second quarter. The largest market in the region, Germany, improved sequentially but was unable to match the prior year's revenue levels.

Straumann's second largest region, North America, grew 4% in local currencies, reflecting a slightly positive currency effect and bringing regional revenue to 93 million francs ($101 million), or 26% of the group.

The sluggish demand in Europe has prompted Straumann to consider acquiring discount implant companies in growing markets such as China, according to news reports. The company may spend as much as 400 million francs ($432.5 million) in the process. Last year, Straumann acquired a 49% stake in Brazil's Neodent.